What is the Capital Stack in Real Estate?

By RJ Johnson June 14, 2023

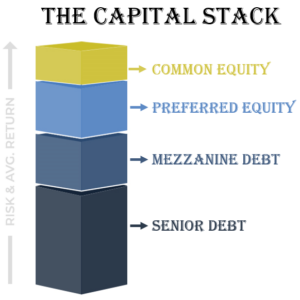

What is the capital stack in real estate? The capital stack in real estate refers to the organization, or tiers, of debt or equity contributed to finance a real estate transaction, or a company, organized by their risk-return profile. These tiers are typically organized from lowest risk, senior debt, to highest risk, common equity. It represents the combination of different capital layers that make up the overall capital structure of a real estate investment. The capital stack typically includes both debt and equity components and the arrangement and priority of these components determine the risk and return profile for both investors and passive investors.

Here are the common components found in a typical capital stack, listed in order of priority:

- Senior Debt: Senior debt is the primary layer of financing in the capital stack. It typically takes the form of a traditional bank loan or a commercial mortgage. Senior debt holders have the first claim on the property’s cash flows and collateral in case of default or foreclosure. They have priority over all other capital providers in terms of repayment. Senior debt is considered a lower-risk investment, and lenders often require collateral and impose covenants to protect their interests. The interest rates on senior debt are typically lower compared to other types of financing.

- Mezzanine Debt: Mezzanine financing fills the gap between senior debt and equity in the capital stack. Mezzanine loans are often provided by private equity firms or specialized lenders. Mezzanine debt holders have a subordinate position to senior debt but rank above equity holders. In the event of default or foreclosure, mezzanine lenders can step in and take control of the property. Mezzanine loans usually carry higher interest rates than senior debt due to the increased risk. They are attractive to investors seeking higher yields, and they provide additional leverage beyond what senior debt offers.

- Preferred Equity: Preferred equity occupies a higher position in the capital stack compared to common equity. Preferred equity holders receive a fixed return or priority distribution before any distributions are made to common equity holders. Preferred equity may offer a higher rate of return compared to senior debt but carries more risk. In the event of liquidation, preferred equity holders have priority over common equity holders in receiving their initial investment back. Preferred equity is often utilized in situations where investors seek a higher yield than senior debt but are not looking for full ownership or control.

- Common Equity: Common equity represents the ownership stake in the property or project. Common equity holders participate in the property’s cash flows and profits but are the last to receive distributions after all other capital providers have been paid. Common equity investors bear the highest risk but also have the potential for the highest returns. They have voting rights and influence over major decisions regarding the property. Common equity can be held by individual investors, partnerships, real estate investment trusts (REITs), or private equity funds.

The specific composition and order of the capital stack can vary depending on the project, investors involved, and the risk-return objectives of the stakeholders. Each layer of the capital stack carries different rights, priorities, and levels of risk and return, reflecting the different interests of the various capital providers.

Tri-Land Properties is a commercial real estate developer that focuses on grocery anchored real estate developments. We have been producing risk-adjusted returns for passive investors since 1978. By investing with Tri-Land, an accredited investor can have access to institutional grade grocery anchored real estate investments run by a 40+ year successful real estate company. To learn more, please contact RJ Johnson at Tri-Land Properties.