What is a Waterfall Structure in Real Estate?

By RJ Johnson June 8, 2023

What is an Equity Waterfall Structure in Real Estate?

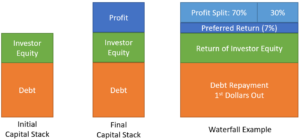

What is a waterfall structure in real estate? In real estate, an equity waterfall structure refers to a method of distributing profits among the participants in a real estate syndication or partnership. It outlines the order and priority in which profits are distributed to the various parties involved. The waterfall structure is typically defined in the partnership agreement or operating agreement and serves as a framework for profit sharing.

Here’s a general overview of how a typical waterfall structure works:

- Return of Capital: The first priority is often the return of the initial capital investment to the investors. This means that any funds invested in the project are distributed back to the investors until they have received their original investment amount.

- Preferred Return: Once the investors have received their initial capital, the next step is to allocate a preferred return to the investors. The preferred return is a predetermined rate of return, typically expressed as a percentage, that the investors are entitled to receive before the general partner (syndicator) receives any profits. This ensures that the investors receive a certain level of return on their investment before the syndicator starts earning profit.

- Profit Split: After the preferred return has been distributed to the investors, any remaining profits are divided between the investors and the general partner according to a predetermined split ratio. This split ratio specifies the percentage of profits allocated to each party. Common split ratios range from 80/20 (where 80% goes to the investors and 20% to the general partner) to 50/50 (an equal split). However, the split ratio can vary depending on the negotiation and terms agreed upon by the parties involved.

- Promote or Performance-Based Profits: In some cases, there may be an additional layer of profit sharing beyond the preferred return and split ratio. This is often referred to as the “promote” or “carried interest.” The general partner, having met certain performance benchmarks or achieved a specific level of profitability, becomes eligible for an increased share of profits above the predetermined split ratio. The promote structure provides an incentive for the syndicator to generate exceptional returns for the investors.

It’s important to note that waterfall structures can be customized and tailored to the specific needs and objectives of the real estate syndication. The specific terms of the waterfall structure, including the preferred return, split ratios, and promote provisions, are negotiated and outlined in the partnership agreement. It’s essential for all parties involved to carefully review and understand the waterfall structure to ensure clarity and alignment of interests.

It’s recommended to consult with legal and financial professionals experienced in real estate syndications to establish an appropriate waterfall structure that reflects the goals, risk profiles, and expectations of the participants.

Waterfall Example

Here’s an example of an equity waterfall structure using a 7% preferred return and a 70/30 split:

- Return of Capital: The initial capital investment is returned to the investors before any profits are distributed.

- Preferred Return: Once the investors have received their initial capital, they are entitled to a preferred return of 7% per annum on their invested capital. This means that the investors will receive a 7% return on their investment before the general partner receives any profits.

- Profit Split: After the preferred return has been distributed to the investors, any remaining profits are divided between the investors and the general partner based on a 70/30 split ratio.

- 70% to Investors: 70% of the remaining profits are allocated to the investors.

- 30% to General Partner: The remaining 30% of the profits are allocated to the general partner.

Assuming the initial capital invested by the investors is $1,000,000, and the project generates a total profit of $200,000.

Return of Capital: The initial capital of $1,000,000 is returned to the investors.

Preferred Return: Assuming the project took one year to generate the profits, the preferred return of 7% per annum on the invested capital would be $70,000 ($1,000,000 x 7%). This amount is distributed to the investors.

- Profit Split: After deducting the preferred return, the remaining profit is $130,000 ($200,000 – $70,000).

- 70% to Investors: The investors would receive 70% of the remaining profit, which is $91,000 ($130,000 x 70%).

- 30% to General Partner: The general partner would receive 30% of the remaining profit, which is $39,000 ($130,000 x 30%).

In this example, the investors receive their preferred return of $70,000 and an additional $91,000 as their share of the profit split, resulting in a total distribution of $161,000. The general partner receives $39,000 as their share of the profit split.

IRR Example

To calculate the Internal Rate of Return (IRR) for the given example, we need to consider the cash flows associated with the investment and solve for the discount rate that equates the present value of those cash flows to zero. Here’s how you can calculate the IRR:

Initial Investment: -$1,000,000 (negative value represents cash outflow)

Cash Inflows:

Year 1: Preferred Return – $70,000

Year 1: Profit Distribution to Investors – $91,000

To calculate the IRR, we’ll input the cash flows into a financial calculator that has the IRR function. The IRR represents the annualized rate of return that makes the net present value (NPV) of all the cash flows equal to zero.

IRR = Calculate IRR(-$1,000,000, $70,000, $91,000)

IRR= 12.36%

The IRR indicates the average annual return that the investment is expected to generate over its holding period, taking into account the timing and magnitude of cash flows. In this case, the IRR suggests that the investment is expected to yield an average annual return of approximately 12.36% based on the cash flows provided.

It’s important to note that this is a simplified example, and in practice, the calculations and distribution may involve more complex factors, including the duration of the investment, additional fees, expenses, and potential hurdles or benchmarks that need to be met before profit distributions are made. The specific terms of the waterfall structure would be outlined in the partnership agreement, and it’s advisable to consult with legal and financial professionals to ensure accurate implementation and understanding.

Catch-Up Equity Waterfall Clause

In real estate syndication, a catch-up clause refers to a provision within the waterfall structure that allows the sponsor or general partner (GP) to receive a higher share of profits until they “catch up” or receive a predetermined percentage of the profits. It is typically used in situations where the GP receives a disproportionate share of profits in the early stages of the investment to compensate for their upfront costs and efforts, but then the profit distribution shifts to favor the limited partners (LPs) as the project progresses.

The catch-up clause ensures that once the LPs have received their preferred return or a certain level of profit, the GP’s share of profits is adjusted to align with the agreed-upon profit distribution. The GP will receive a greater share of profits until they reach their catch-up threshold, after which the profit distribution is typically adjusted to favor the LPs.

Here’s a simplified example to illustrate how a catch-up clause works in a real estate syndication equity waterfall structure:

Let’s say the equity waterfall structure is structured as follows:

Preferred Return: LPs receive an 8% annual return on their invested capital.

Catch-Up: Once LPs receive their 8% preferred return, the GP receives 30% of the remaining profits until they catch up to a cumulative total of 20% of the total profits.

After the Catch-Up: Once the GP has received its 20% catch-up share, the remaining profits are distributed between the GP and LPs, typically with a ratio of 70% to LPs and 30% to GP.

Suppose the project generates $1 million in profits. In the first year, the LPs would receive their 8% preferred return, which amounts to $80,000. The remaining profits are $920,000.

With the catch-up clause, the GP will receive 30% of the remaining profits until they catch up to 20% of the total profits. In this case, the GP would receive $276,000 (30% of $920,000) in addition to the preferred return, bringing their total share to $356,000.

After the catch-up threshold is reached, the remaining profits of $644,000 would be distributed between the LPs and GP according to the predetermined ratio (70% to LPs and 30% to GP). In this example, the LPs would receive $450,800 (70% of $644,000), and the GP would receive $193,200 (30% of $644,000).

Please note that the actual catch-up clause terms and percentages can vary depending on the specific agreement between the GP and LPs in a real estate syndication. It’s important to review the partnership agreement or offering documents for precise details on how the catch-up clause operates in a particular investment.

Tri-Land Properties is a commercial real estate developer that focuses on the redevelopment of grocery anchored real estate projects. We have been evaluating real estate projects and evaluating equity waterfall structure since 1978 for passive real estate investors. Accredited investors can have access to institutional grade grocery anchored real estate investments. To learn more, please contact RJ Johnson at Tri-Land Properties.